Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group, Column N.A., and Evolve Bank & Trust®; Members FDIC.

Climate tech has big goals. This is banking that helps you get there.

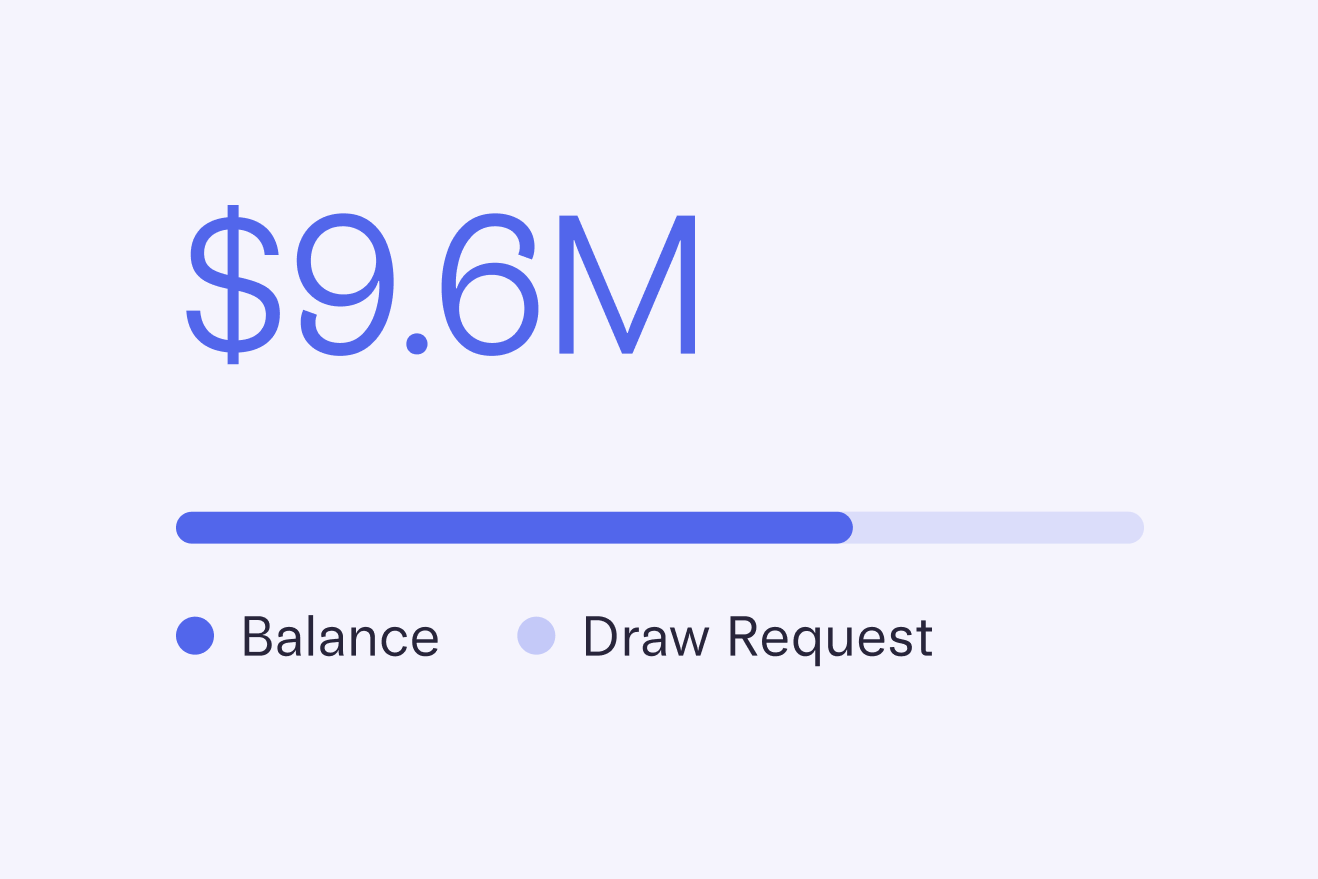

Boost your runway

Access a range of climate financing solutions, from climate-focused grants to venture debt.

Climate-specific perks

Get discounts on carbon credit programs, plus emissions & ESG tracking solutions.

Support from experts

Our relationship managers specialize in your industry — and they’re with you every step of the way.

Grow your community

Connect with other climate founders via our founder success platform, Mercury Raise.

A built-in climate ecosystem

We regularly host climate events across the country to connect you with investors, partners, and more.

Everything you need for smooth banking

Bank at your speed

Apply Now- Fast online application and onboarding

- Start spending immediately with virtual cards

- Complete any banking task in just a few clicks

- Bank on-the-go with an intuitive mobile app

Simple money transfers

Learn More- Deposit money and pay vendors in three clicks

- Pay via ACH, check, or wire

- Create auto-transfer rules between accounts

- Set up recurring payments

- Easily share receipts with your team

Physical and virtual cards

Issue corporate cards in seconds — complete with custom limits, searchable transactions, and user permissions for teammates, bookkeepers, and contractors.

Learn MoreYour needs are our priority

Access an entire financial platform powered by the bank account

Why climate companies choose Mercury

Mercury is built by entrepreneurs for entrepreneurs. With their unrivaled Venture Debt and all-in-one platform, they’re the ideal partner for us to build and scale our business long-term.

Jonathan Segal

Co-founder & COO

Zeno Power

Climate tech

The Mercury team’s support in serving the needs of climate companies is unmatched.

Brennan Spellacy

Co-founder and CEO

Patch

Climate tech