Mercury

$0/ Month

Powerful business banking and finance essentials.

Mercury is a fintech company, not an FDIC-insured bank. Banking services provided by Choice Financial Group, Column N.A., and Evolve Bank & Trust, Members FDIC. Deposit insurance covers the failure of an insured bank.

Generate invoices with a personal touch in minutes

Customize your invoices with your company’s logo and preferred color scheme.

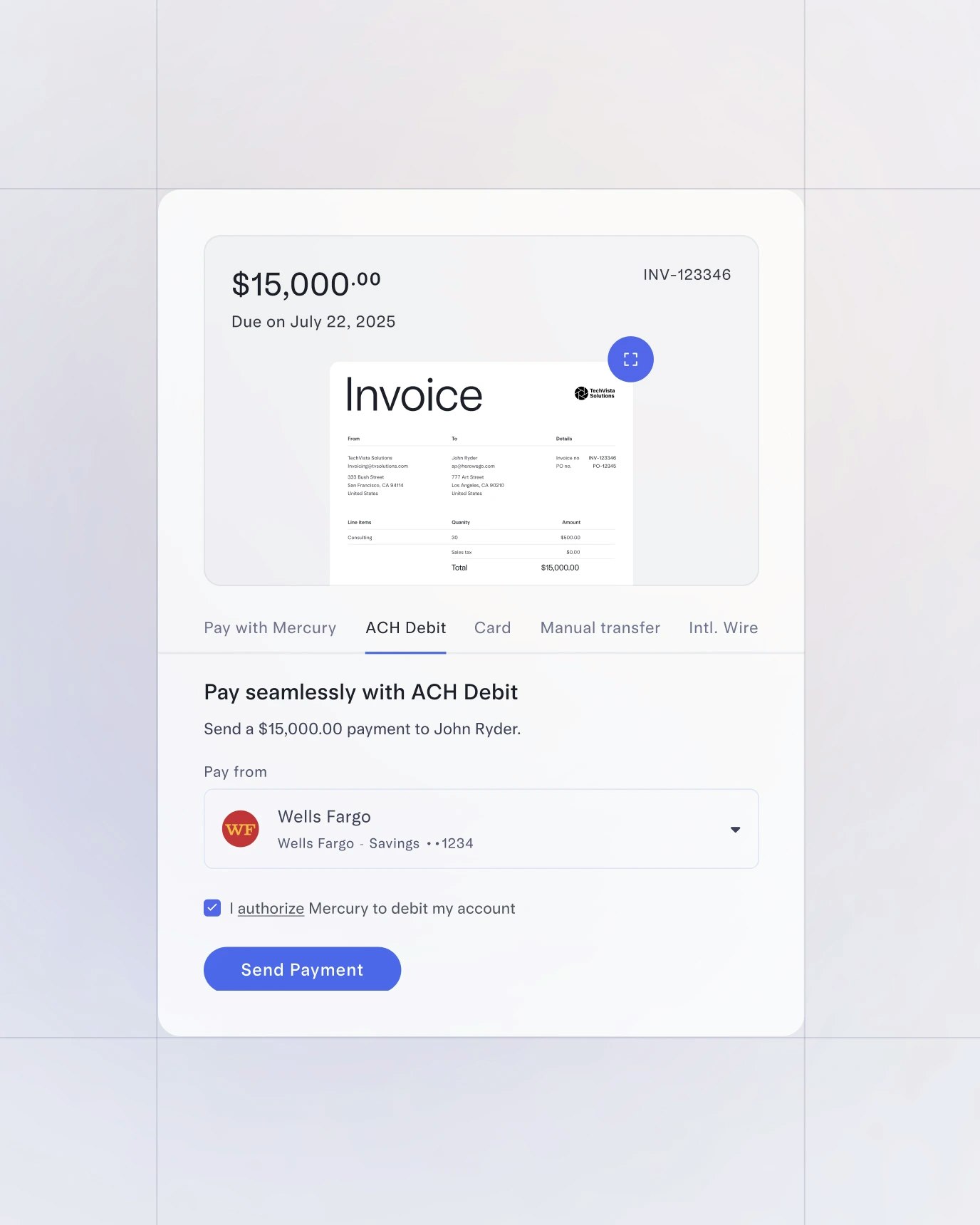

Receive payments the way you want

Give your customers the flexibility to pay by credit card, Apple Pay, Google Pay, wire, ACH transfer, or ACH debit for subscribers.

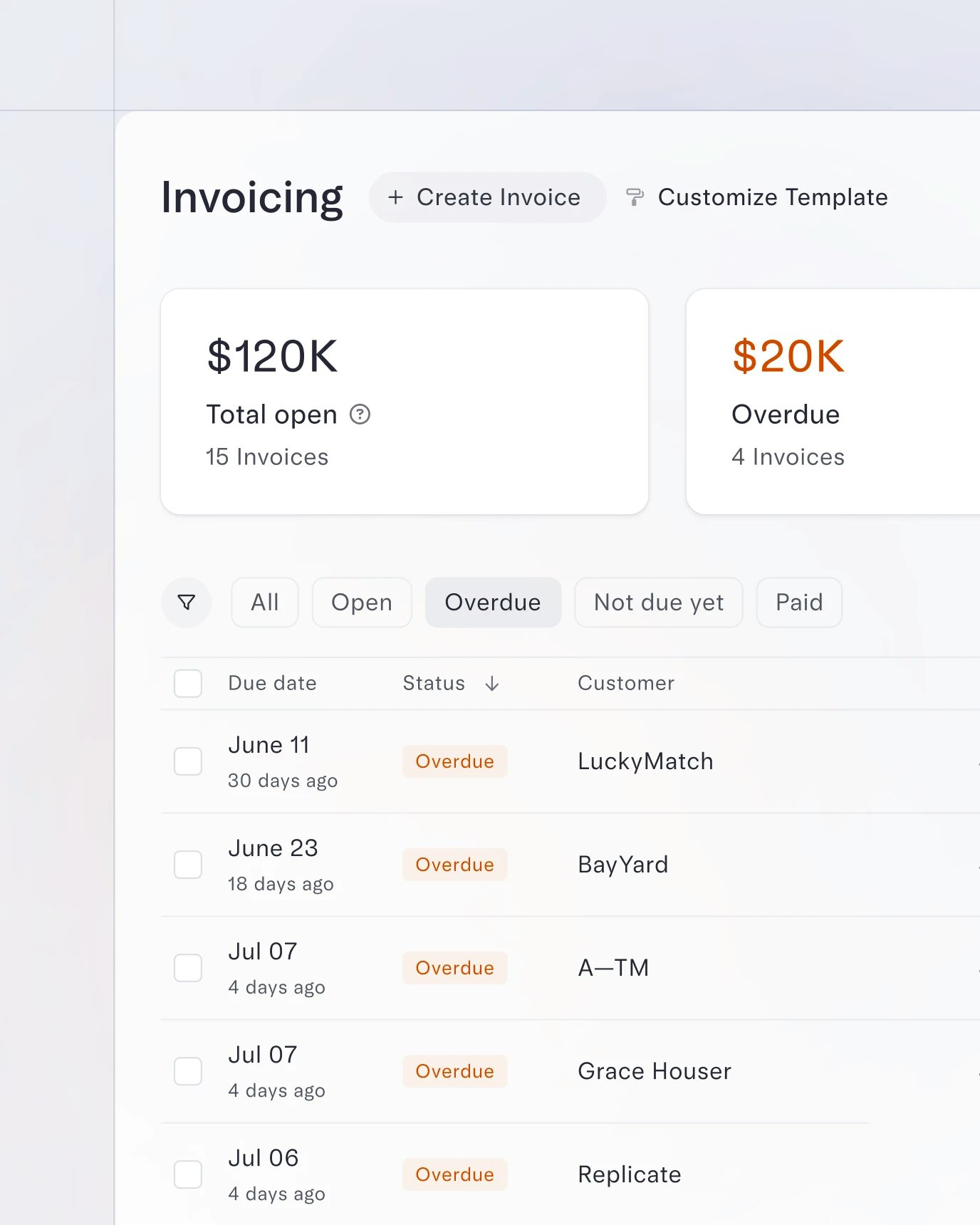

See the status of all your invoices at once

With a quick snapshot, you can view who owes you what, filter by status, and take action from there.

Reduce reconciliation time with invoicing and banking in one

Incoming payments are matched to the right invoices automatically, saving you time and brainpower.

Empower your team with the right level of access

Grant special permissions to your finance team or bookkeepers and decide who has access to request payments.

Stay in sync with your accounting software

Automatically import all your invoice payments to QuickBooks, NetSuite, or Xero.

$0/ Month

Powerful business banking and finance essentials.

$35/ Month

Everything Mercury offers, with more reimbursements and invoicing power.

Unlimited bill payments

Unlimited invoice generation

Recurring invoicing

Branded invoices

ACH debit

+ $1/ACH debit transaction

Reimburse up to 20 users/month

+ $5/additional active user

Xero

QuickBooks

$350/ Month

Everything Mercury Plus offers, with advanced workflows and dedicated support.

Unlimited bill payments

Unlimited invoice generation

Recurring invoicing

Branded invoices

ACH debit

+ $0/ACH debit transaction

Reimburse up to 250 users/month

+ $5/additional active user

Xero

QuickBooks

NetSuite

Relationship manager

Also guaranteed at $10M+ balance

It takes seconds to generate formal invoices, which I really appreciate. It's very easy and self-explanatory. Plus, it keeps everything organized – not only for us, but also for our clients.

Aizada Marat

CEO and Founder

Alma

Legal services

Mercury makes the invoicing process so smooth, intuitive, and easy — like decaf-level relaxed. It now seems so obvious that invoicing should be nested right in with your banking.

Matthew Smith

Founder

Wimp Decaf Coffee Co

Ecommerce

As a small business owner, invoicing has always been cumbersome and manual. Mercury Invoicing makes it intuitive, simple, and far faster. And best of all, it keeps everything in Mercury.

Nathan Sanow

President

MasterCare LLC

Insurance

Mercury is a fintech company, not an FDIC-insured bank. Banking services provided by Choice Financial Group, Column N.A., and Evolve Bank & Trust, Members FDIC. Deposit insurance covers the failure of an insured bank.