You must have an account with Mercury and meet deposit minimums to become eligible for IO.

Engineered for the startup journey

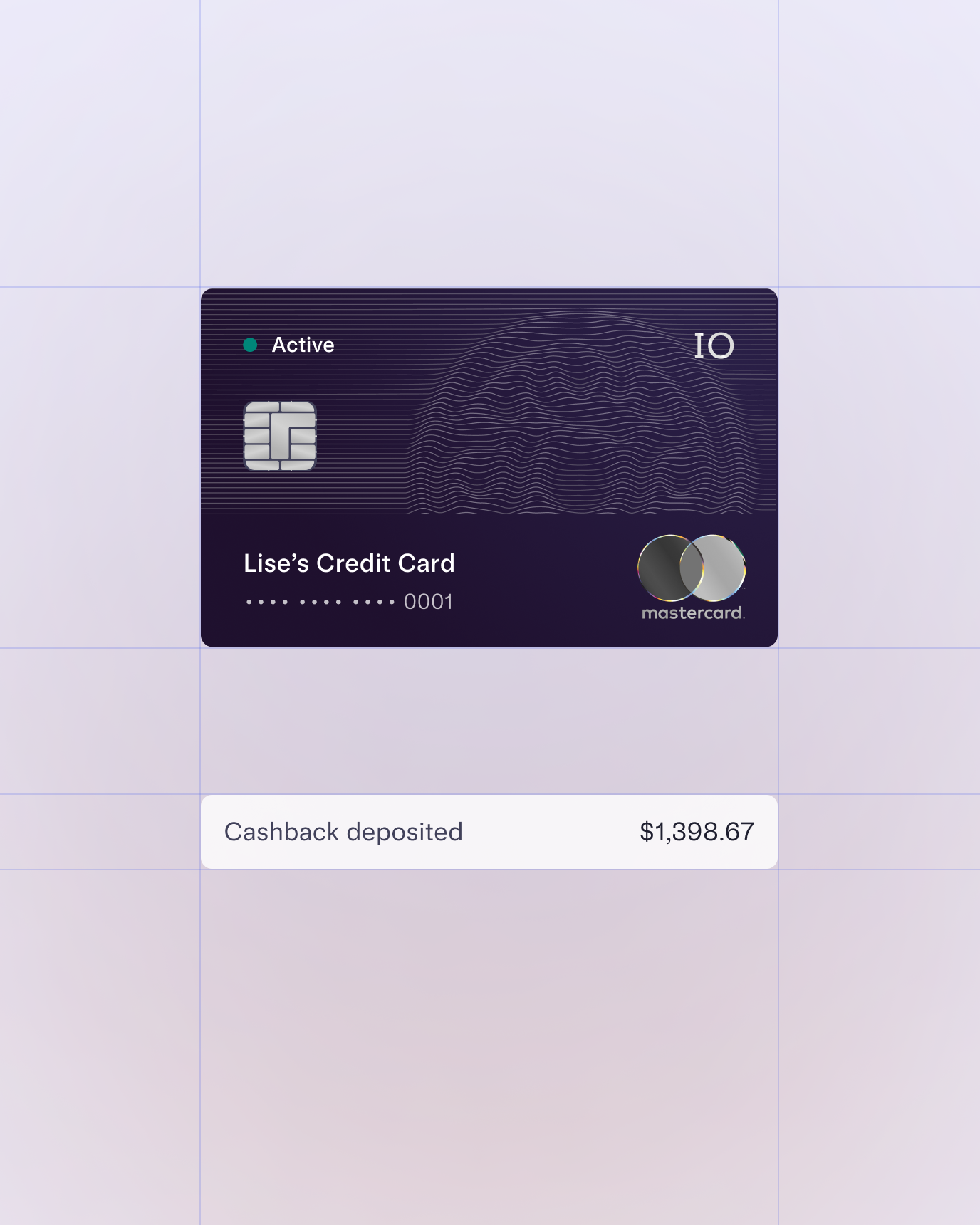

1.5% cashback on all spend

Easy and straightforward rewards

Higher credit limits for startups

Harness more spending power

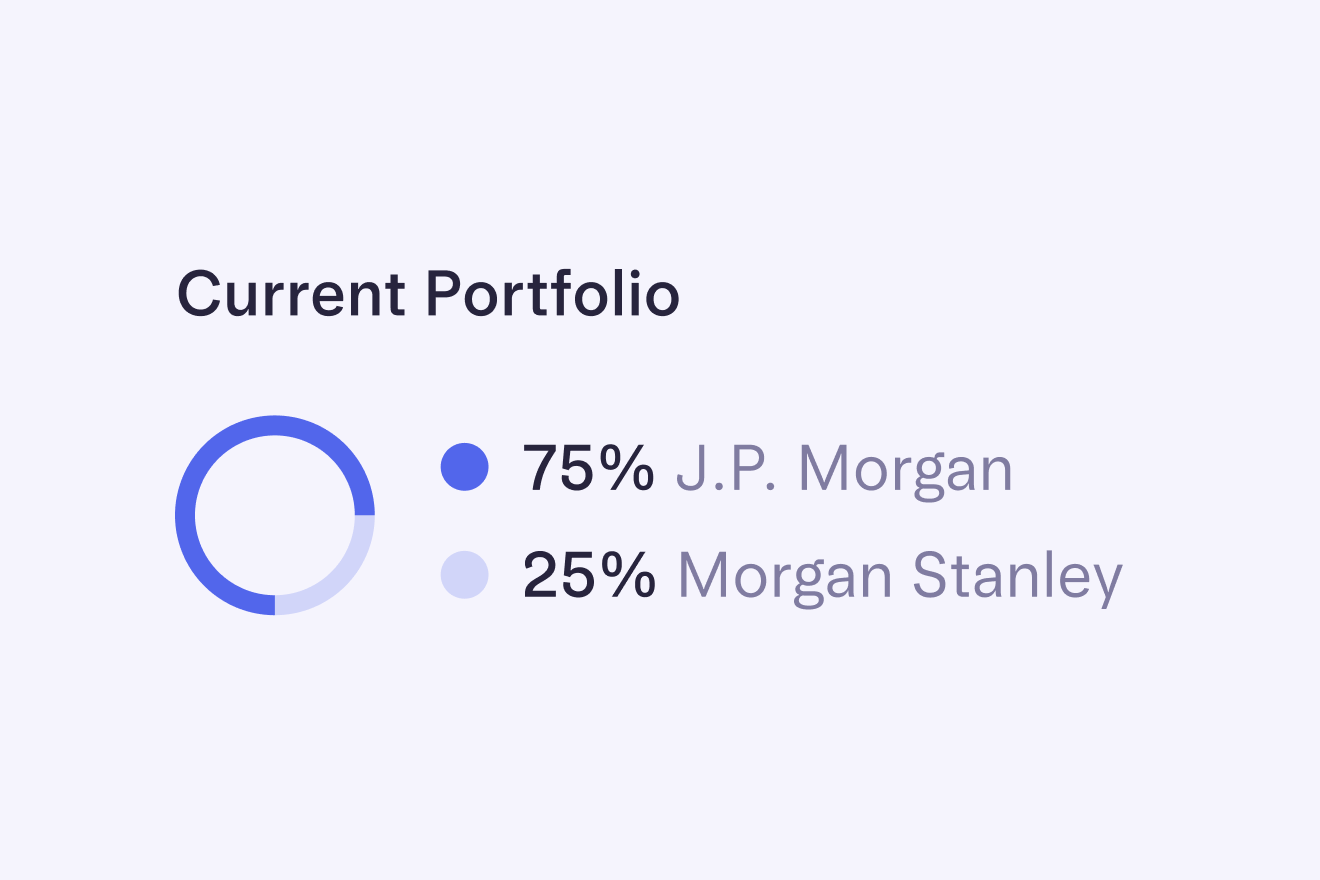

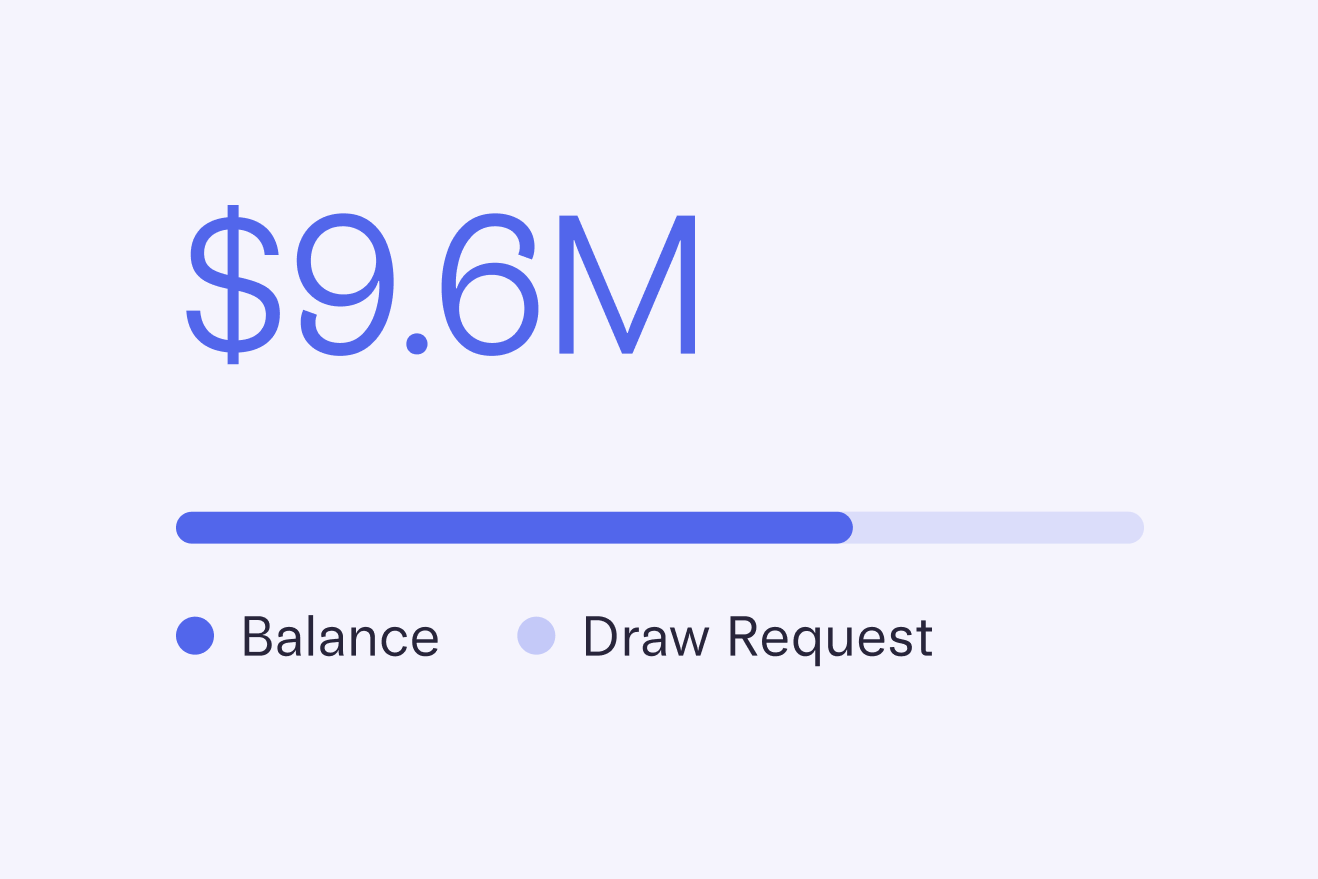

Low cash balance minimum

Qualify with a $25K balance

Instant virtual cards for your team

Start spending immediately

Spend management tools

Maintain control as you scale

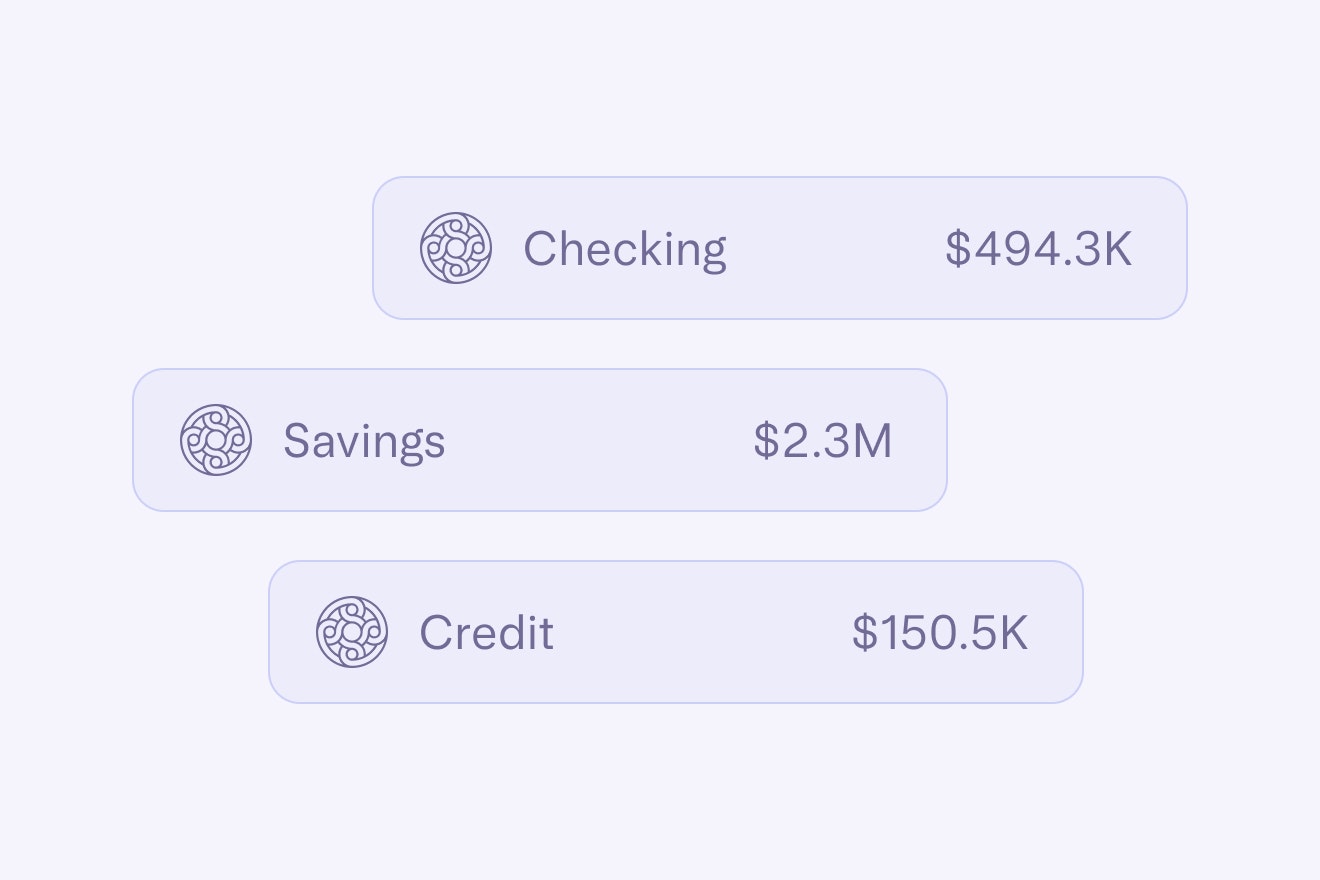

Simplify your finances

Consolidated banking and cards

Scale confidently with powerful spend management tools

Cards for your team

Issue as many cards as you need to your team — individually or in bulk with our HR and payroll system integrations.

Get time back with built-in finance automations

- Sync transactions to QuickBooks, Xero, and NetSuite

- Automate categorization with accounting rules

- Surface GL codes in Mercury for accurate categorization

There’s more to IO

- No interest or annual fees

- Mastercard Zero Liability and Fraud Protection

- Discounts on tools like Microsoft and Adobe

- Can help improve your business credit score

- Support when you need it via chat or email