Mercury is a fintech company, not an FDIC-insured bank. Banking services provided by Choice Financial Group, Column N.A., and Evolve Bank & Trust, Members FDIC. Deposit insurance covers the failure of an insured bank.

Unlock international capabilities

Easily send wire payments from your entities to your portfolio companies.

Expedite operational efficiencies

Connect with Plaid for ACH transfers and use foolproof instructions to send speedy wires to your portfolio companies. Plus, you can specify a designated approver for each transfer before syncing it to QuickBooks, Xero, or NetSuite.

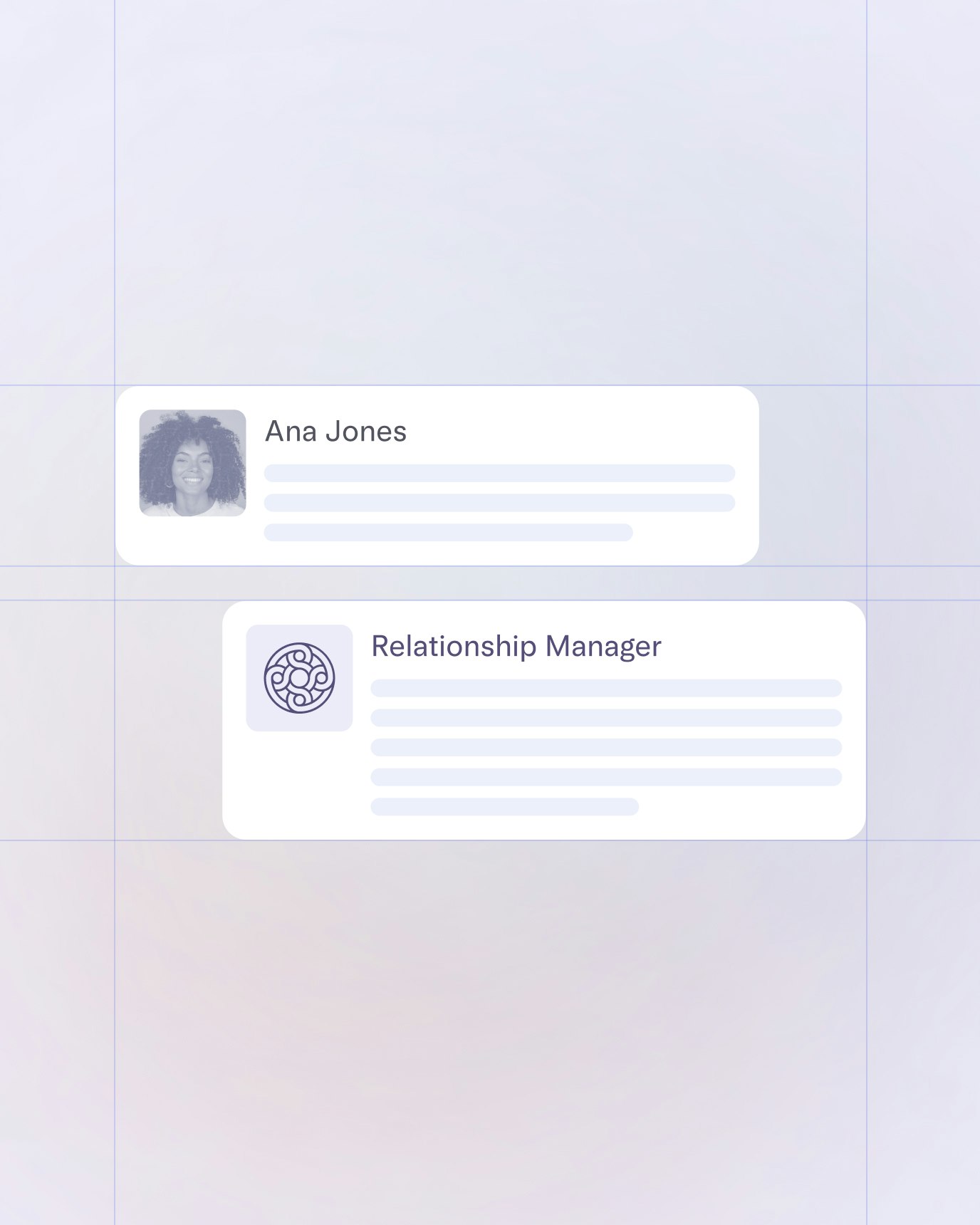

One-on-one expert guidance

Your needs come first — and high-touch, white-glove service is part of the Mercury package for VC funds. Bank with confidence knowing your dedicated relationship manager is always one message away.

Manage all your accounts from one place

Create separate accounts for your fund, your SPVs, and your management company — and toggle between them with ease.

But don’t just take it from us

Mercury has been a fantastic partner for us and our portcos. Their customer service is lightning speed, and they prioritize security, safety, and asset protection. Not to mention, the whole experience is modern and elegant.

Zann Ali

Partner

2048 Ventures

Venture Capital

Mercury’s modern interface is a nice alternative to dated banking interfaces we’ve used previously. Lots of attention to detail with thoughtful features like free wires, easy-to-digest dashboards, and easy-to-manage cards and bill payments.

Wiz Abdullah

Co-Founder & Partner

Spacecadet Ventures

Venture Capital

Managing and supporting my portfolio couldn’t be easier with Mercury. The whole experience feels really centered around trust, security, and ease-of-use — it’s such a source of confidence for both me and my portfolio companies.

James Beshara

Angel Investor

Venture Capital