Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group, Column N.A., and Evolve Bank & Trust®; Members FDIC.

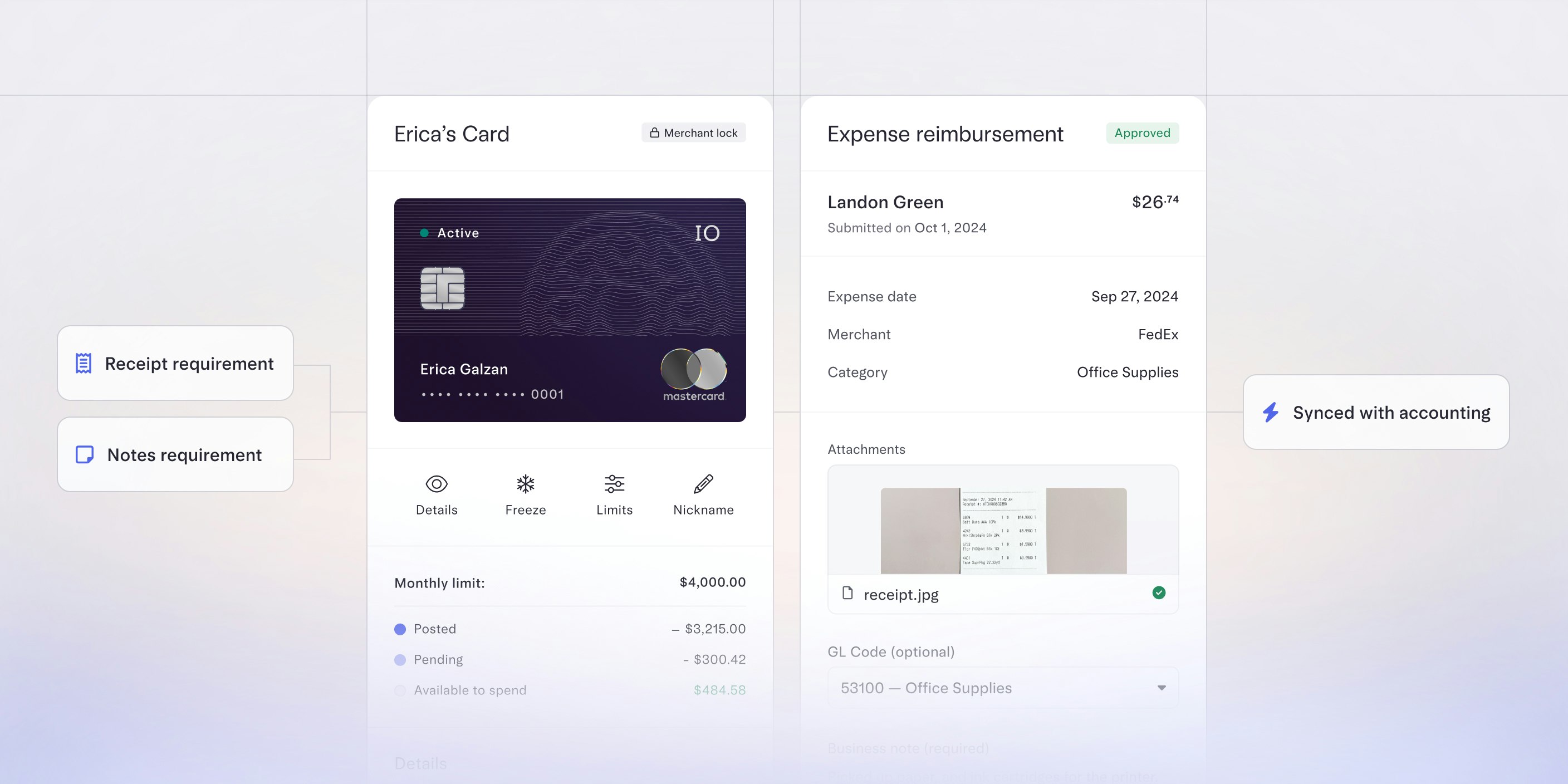

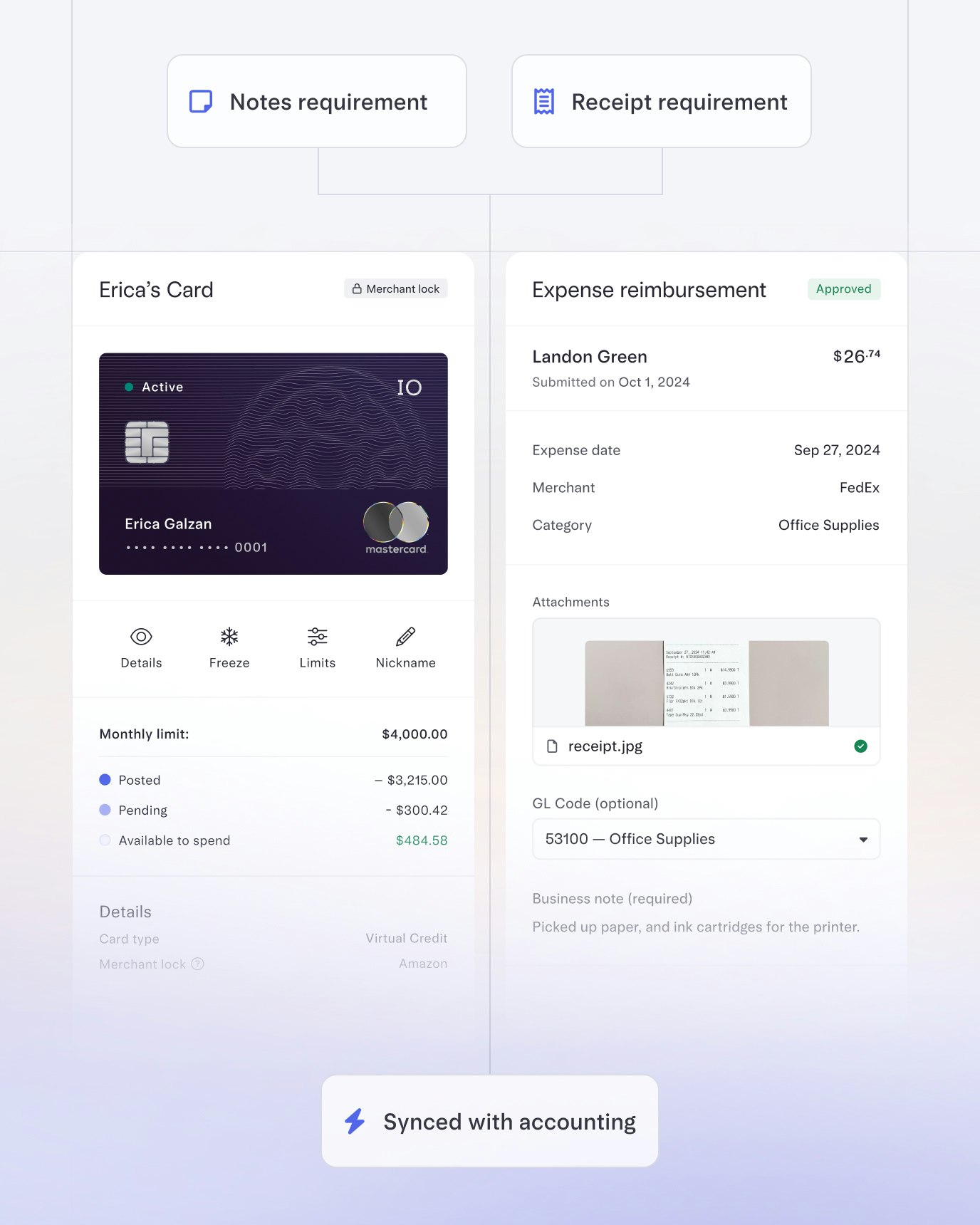

Effortlessly control spend

Set granular controls and spend policies to ensure employees spend responsibly.

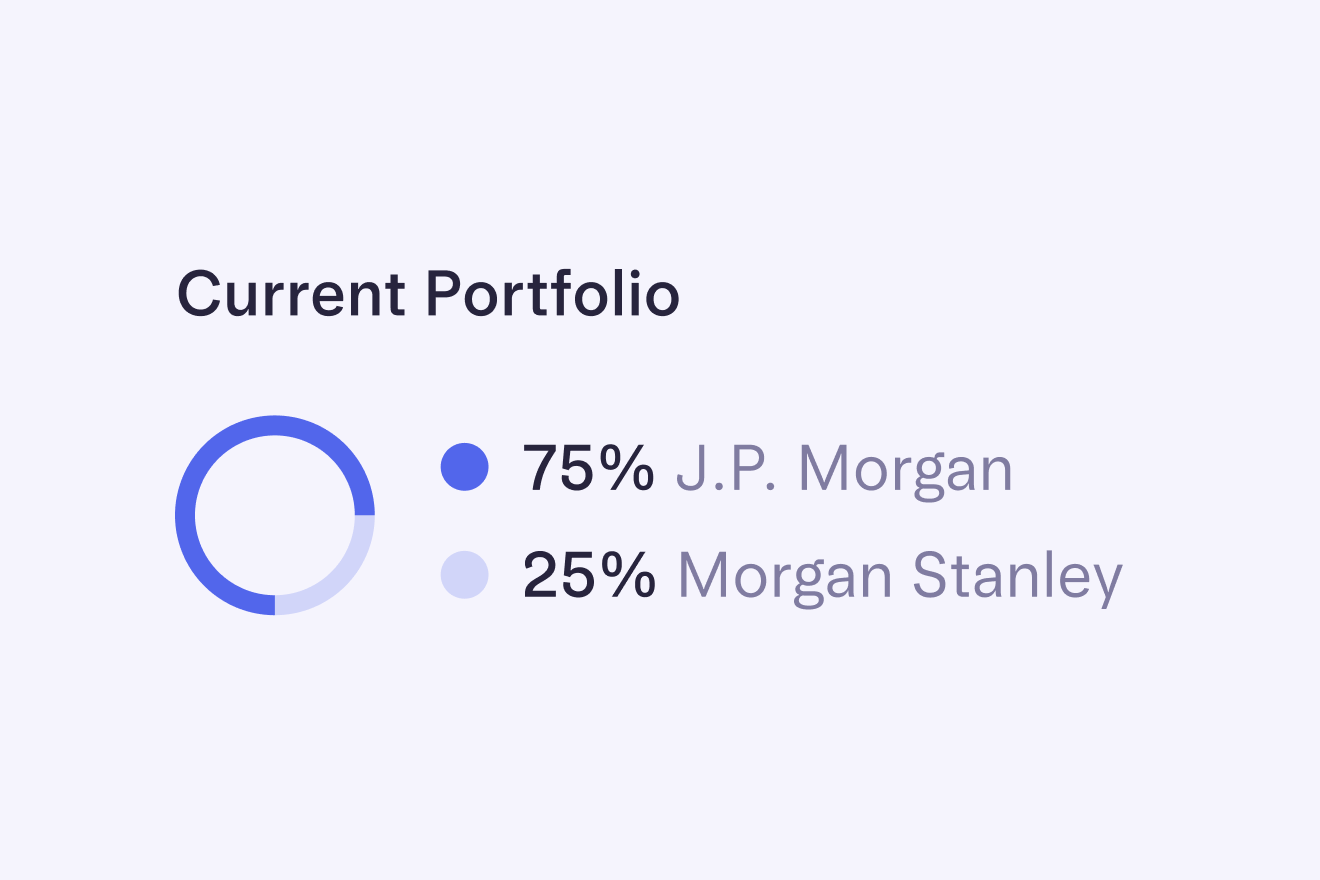

Keep account info private

Give users expense tools without granting access to your bank account details.

Simplify month-end close

Sync to accounting software like QuickBooks, Xero, or NetSuite.

Get started in minutes

A simple setup, automations, and an intuitive experience save your team time.

A toolkit for time and money well spent

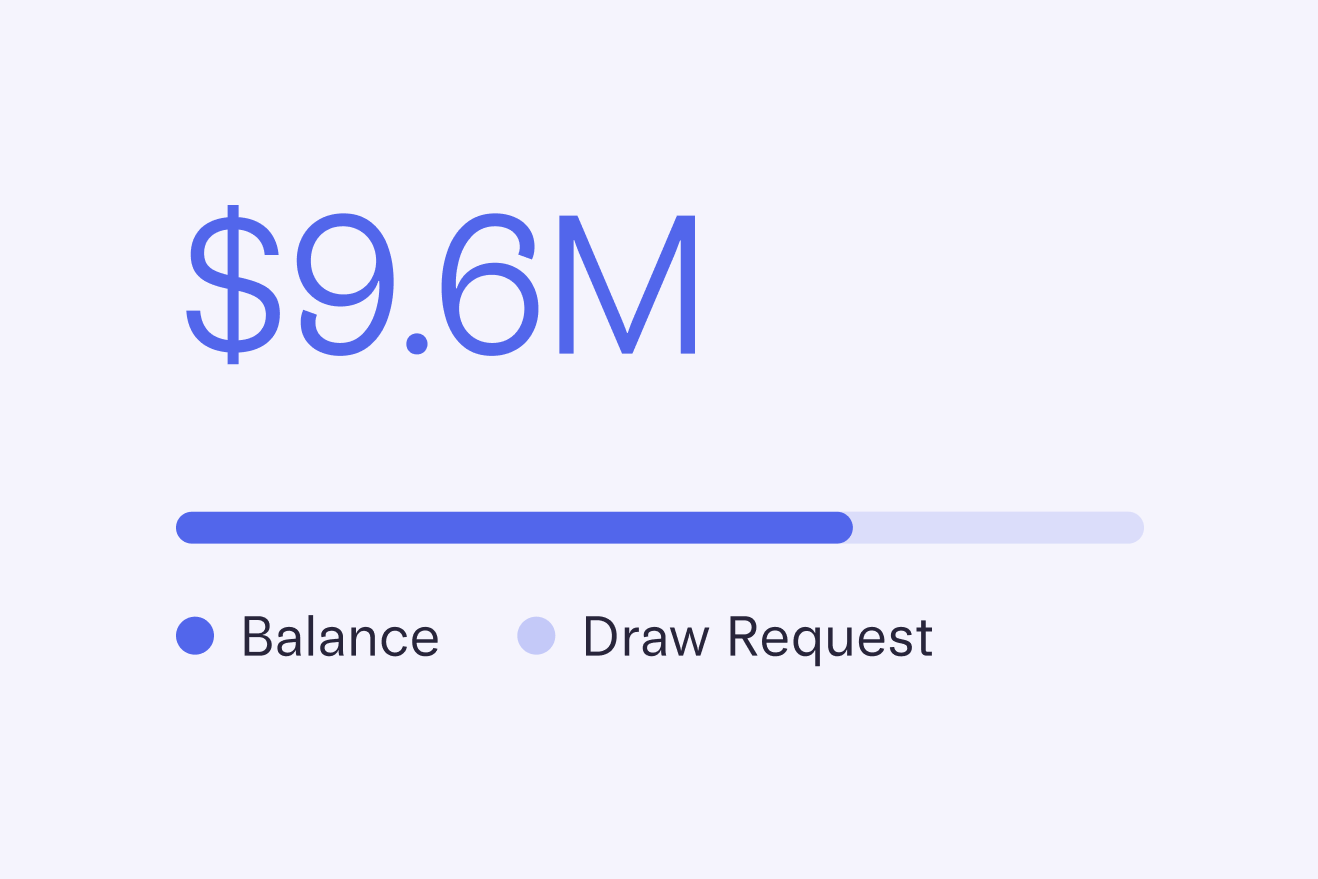

Use corporate cards to control spend upfront and earn 1.5% cashback

Explore Corporate CardsReimburse out-of-pocket expenses with ease

Explore Reimbursements Pricing- Reimburse expenses for up to five active users per month for free

- Submit expenses in seconds, with data auto-scanned from receipts

- Reimburse expenses in two clicks, individually or in bulk

- Set policies for receipts, notes, and submission timeframe

- Get a snapshot view of expenses that are out-of-policy or need review

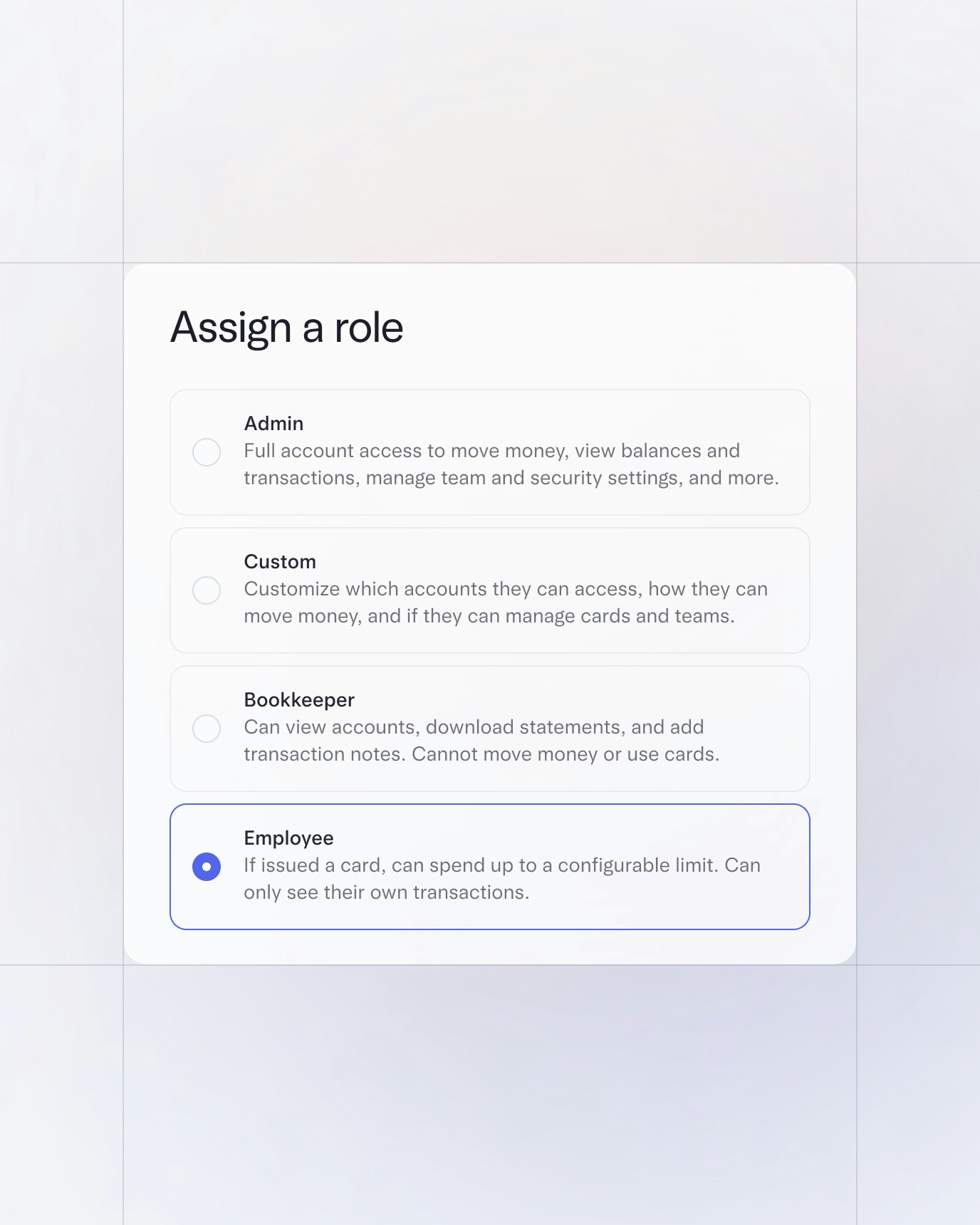

Invite teammates to access only what they need

- Offer your team cards and reimbursements without granting access to your bank account details

- Add and manage employees by integrating your HR and payroll system.

- Assign tiered user permissions to co-founders, bookkeepers, employees, and freelancers

Cut the busywork and let your team focus on what counts

Tick off just about any task on the go

Easily create cards, submit expenses, upload receipts, and more in seconds, all on the mobile app.