Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group; Member FDIC.

One subscription, endless ways to optimize your money

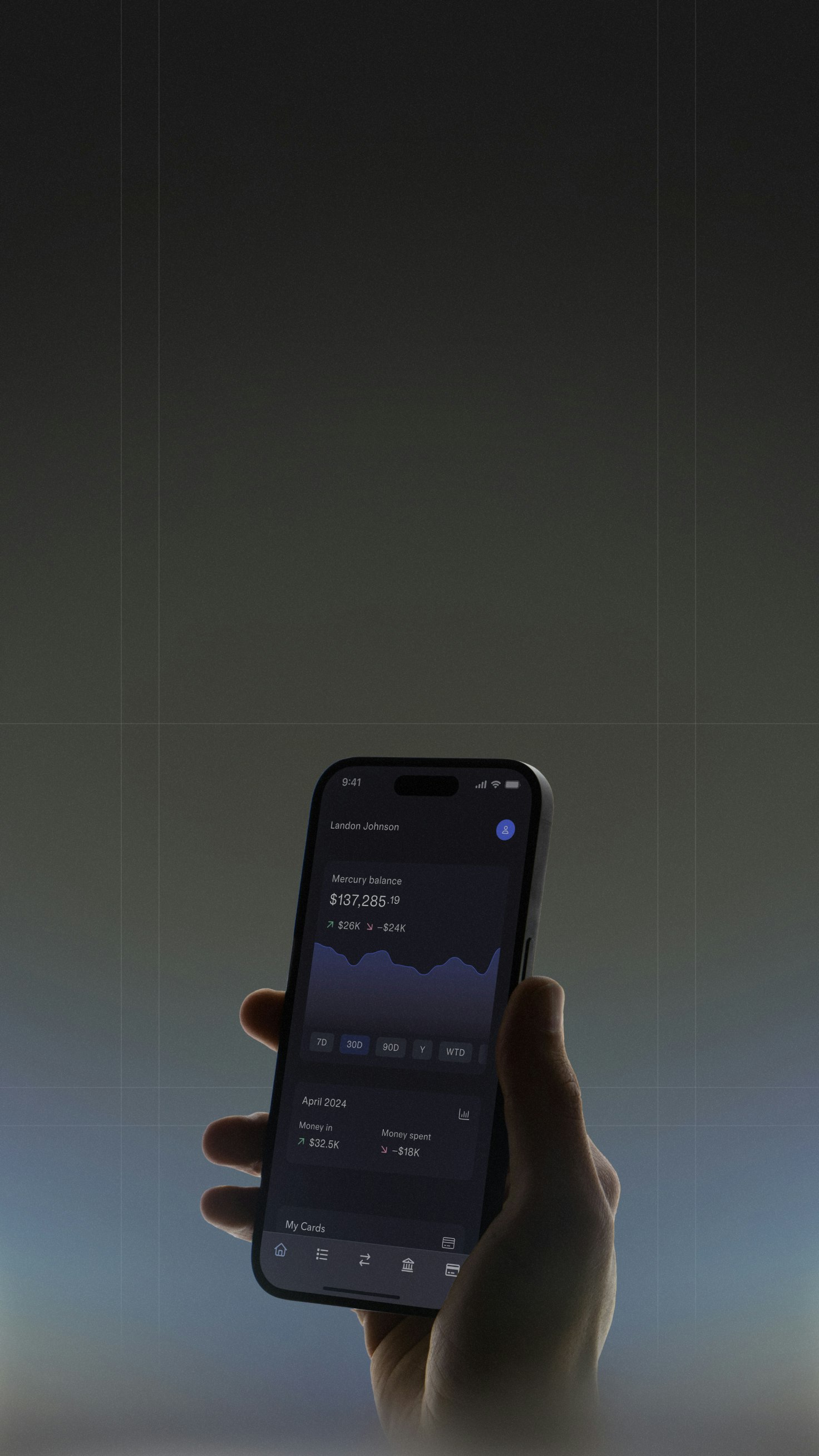

Make banking a breeze

Send no-fee domestic wires, set auto-transfer rules, drag-and-drop bills, and tackle tasks in no time.

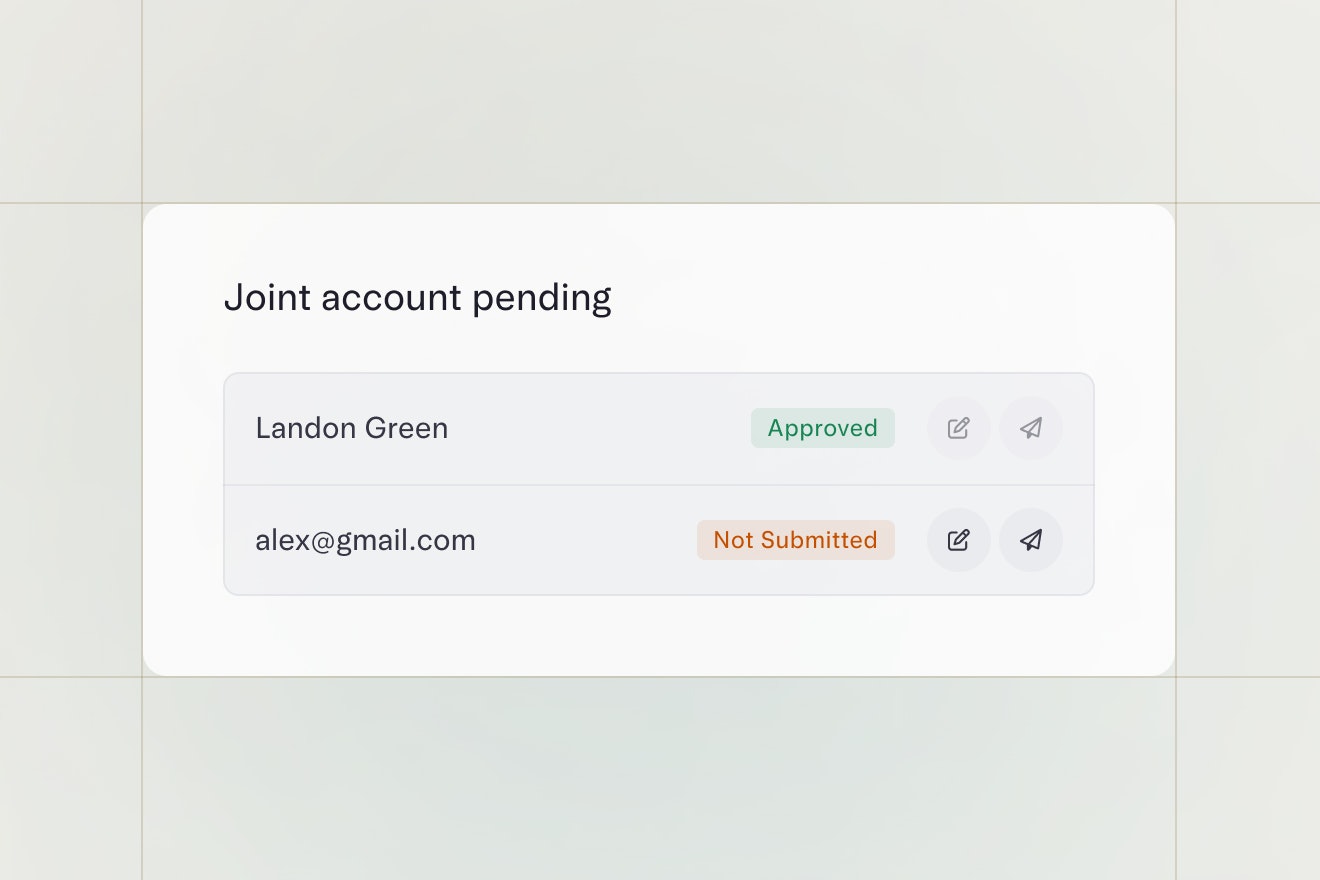

Manage your finances, together

Share access with anyone with custom user permissions or create a joint account with your spouse or partner.

Your financial operating system just got an upgrade

Make money moves without manual tasks

- Create an account for every goal or expense

- Set auto-transfer rules between accounts

- Send no-fee domestic wires in seconds

- Drag-and-drop bills to pay them in a click

Room for everyone in your life

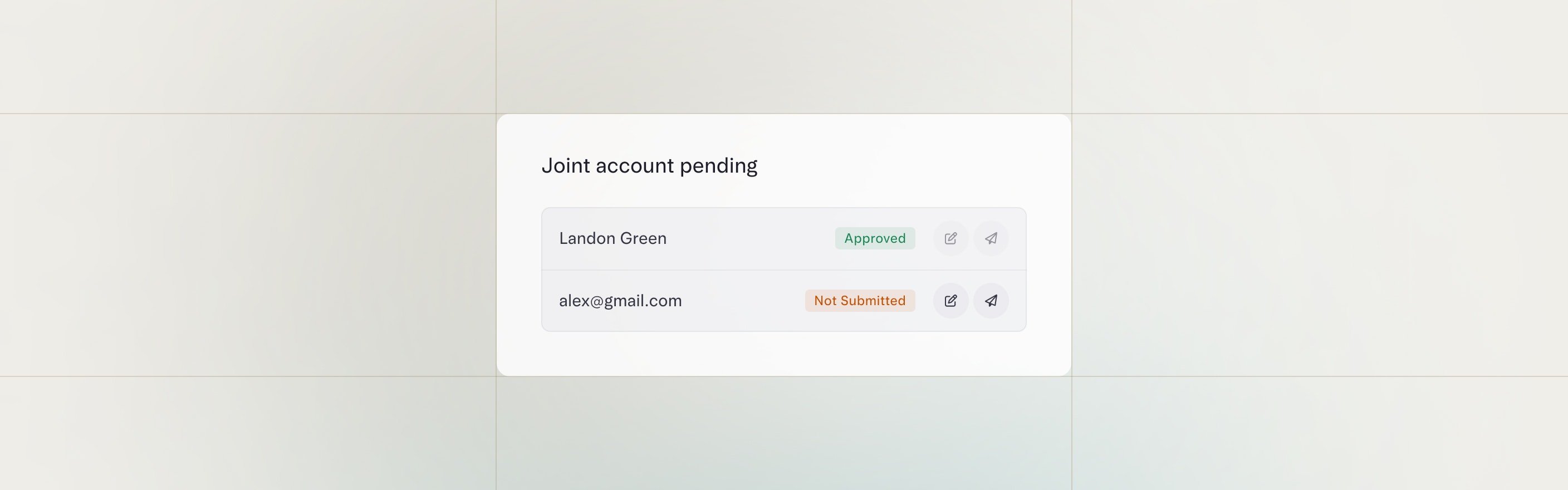

A joint account for your shared finances

Manage your finances like a winning team with joint accounts for up to four account owners.

$240 annually, $0 in surprise fees

- IncludedUnlimited no-fee domestic wires, ACH, and check payments

- IncludedMultiple checking and savings accounts

- IncludedJoint account

- Coming soonInvestment account

- Coming soonInternational wires

How Mercury Personal stacks up

Mercury Personal is so different from the traditional alternatives — it’s in a class of its own. It’s fast and easy to send wires for investments, the APY I earn is fantastic, and I’ve enjoyed the granular permissions for giving a loved one access to the account.

Rajiv Ayyangar

CEO

Product Hunt

Content

Mercury Personal has already seamlessly integrated into my life. It is nothing short of revolutionary for consumer accounts, which have long felt disconnected from the tech sector’s pace and innovation. It has the seemingly simple and magical features that have always set Mercury above the rest.

Shane Mac

Co-founder & CEO

XMTP

Web3

Huge fan of Mercury Personal. Top-notch user interface. Unlimited wires. Reimbursed ATM fees. Plus, a high-yield savings account. It’s the account I’ve been dreaming of for my personal finances.

Ethan Bloch

Founder & CEO

Digit

Fintech

Mercury is the new gold standard for personal accounts. I love that wire payments are included and I can create interest-bearing sub-accounts to set money aside for capital calls, taxes, etc. The experience is already beyond any other product out there — and it’s only getting better!

Jake Zeller

Founder

Powerset

Venture capital