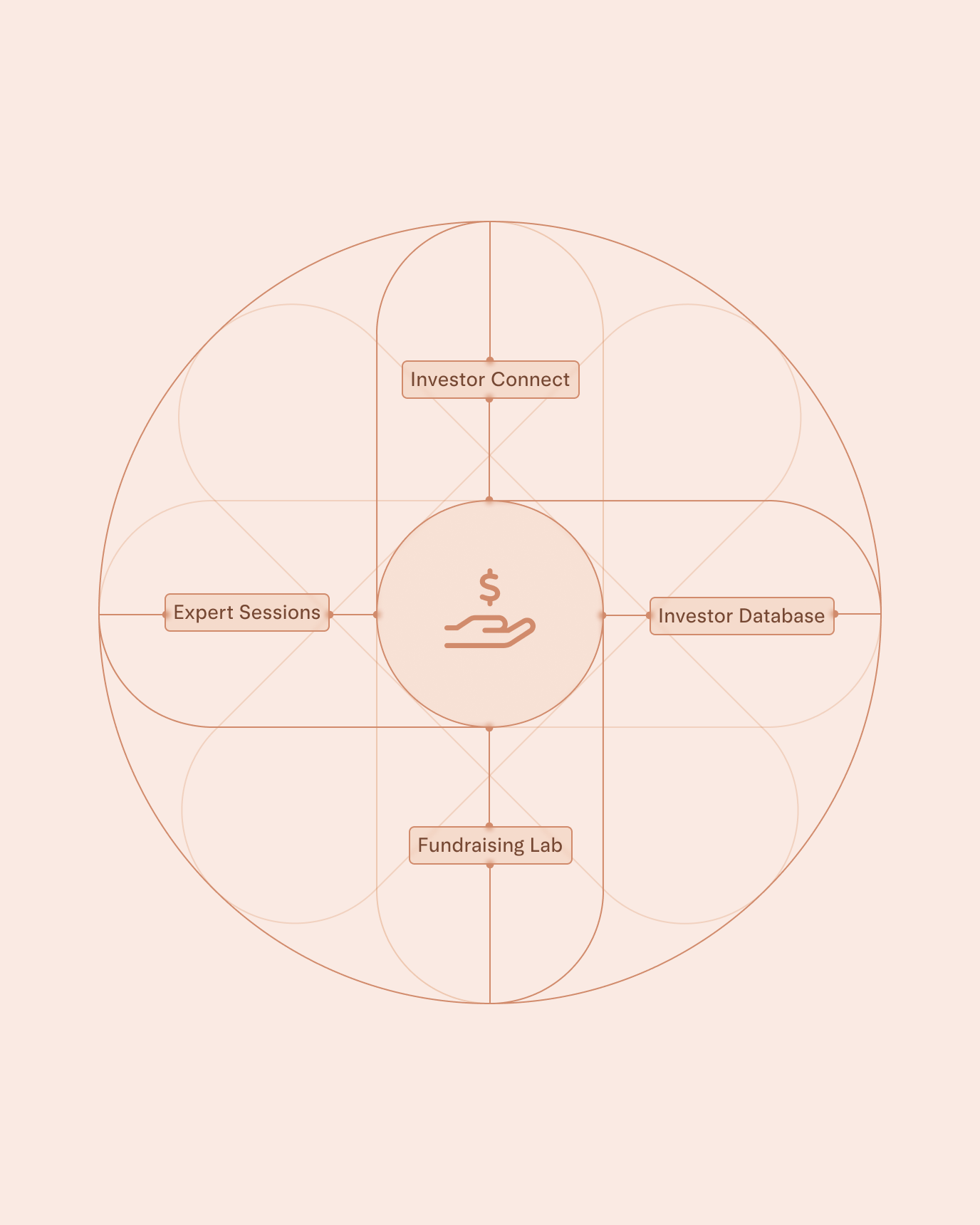

Support at every step of your fundraising journey

Find the right program for your current goals

- First-time founder? Try Fundraising Lab.

- Actively fundraising? Try Investor Connect.

- Plus, fundraising-focused tools and resources for support at every stage.

More fuel for your fundraise

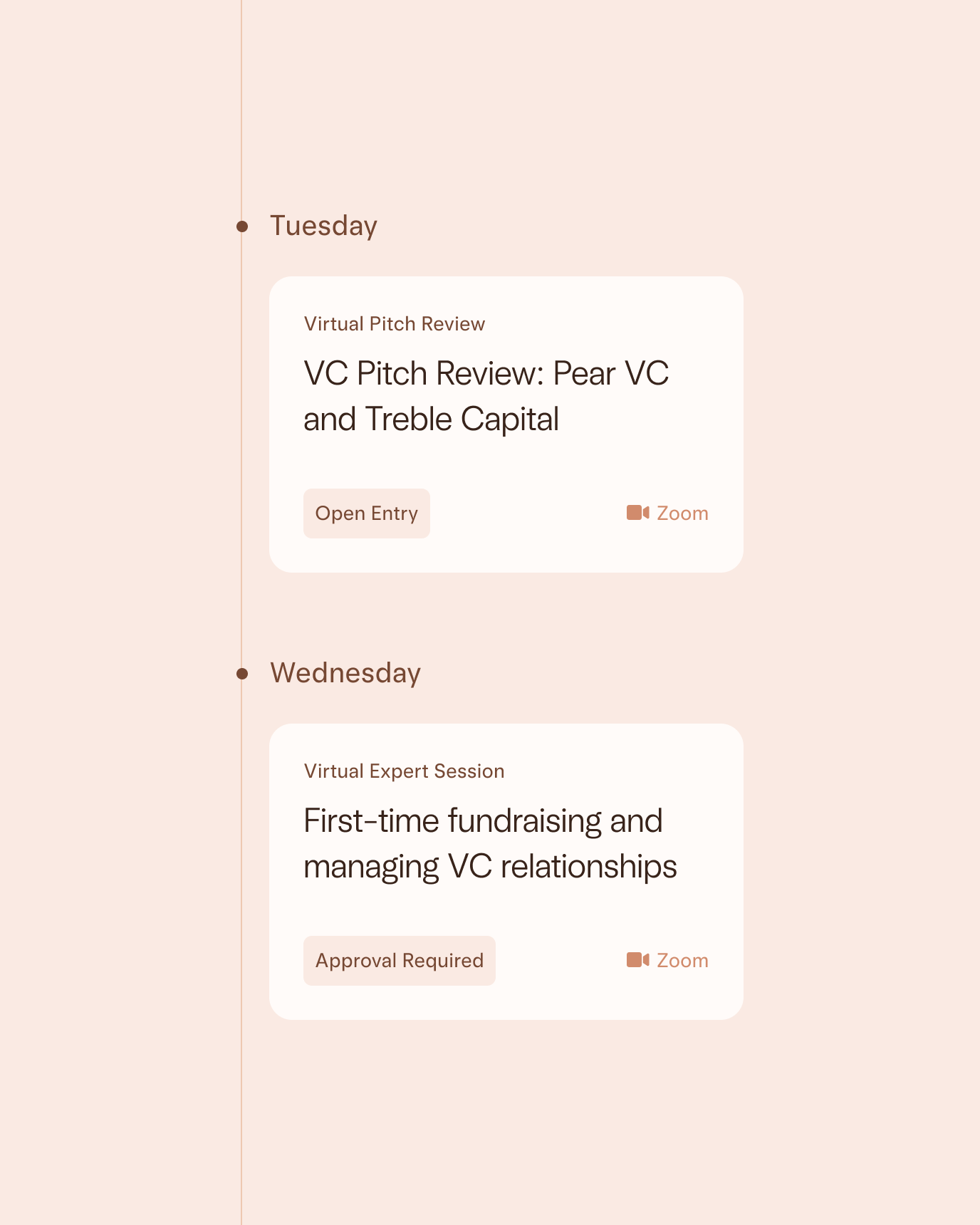

Fundraising Expert Sessions

Get answers to your fundraising questions directly from top investors and experts — live on Zoom or on demand.

See Upcoming Sessions

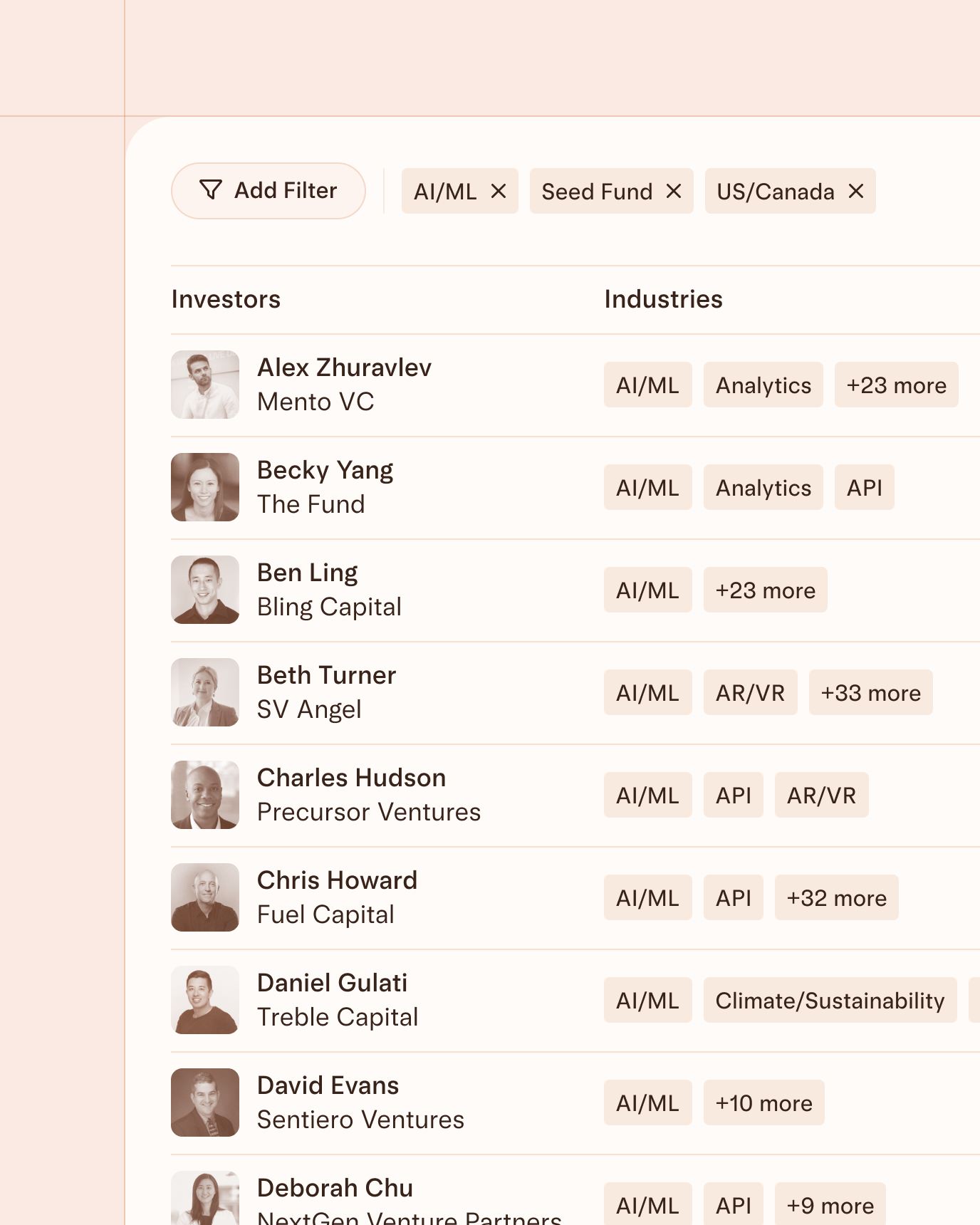

Investor Database

Explore our database of active investors and funds to find your next investment partner.

Browse Database

The proof is in the progress

Fundraising Lab sessions were incredibly helpful with actionable takeaways from each session. If you've ever done a fundraising workshop and thought "okay but how do I actually implement that?"- Fundraising Lab is what you're looking for.

Tyce Herrman

Founder

Ulama

Software

We raised $2.5M from firms like Mucker, Pear, and Foundation Capital. Mercury has been crucial to our success & vision.

Justin Clegg

Founder

Allset

Software

Raise has been a great source of new and exciting companies who are actively fundraising.

Josh Kopelman

Investor

First Round Capital

Seed-stage VC firm

1 / 3

Your questions, answered.

Let the deals flow

We're here to help you secure the capital you need to grow.